Help to Buy: Equity Loan

Getting yourself on the property ladder can often be difficult, with many people requiring a little bit of financial support because of the large cash deposits that are often required when purchasing their first home.

However, this doesn’t mean it is impossible as there are options available that can provide you with this support. A popular scheme, amongst first time buyers, is the newly introduced Help to Buy: Equity Loan, which is a government scheme that aims to help first time buyers get on the property ladder by providing them with an equity loan that can be put towards the cost of buying a new build property.

How does the help to buy: equity loan work?

The Help to Buy: Equity Loan was introduced to make purchasing a property much more achievable, as it means buyers are only required to have a 5% deposit. With an equity loan, the Homes and Communities Agency can lend you between 5% and 20% (or 40% if you are purchasing a property in London) of the market value of your home.

How much of a deposit do I need?

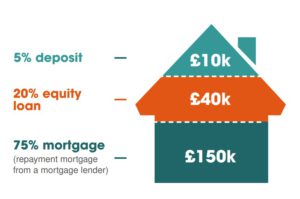

The deposit required will vary depending on the property you are purchasing, as you will need to pay a 5% deposit of the purchase price of your new home at the exchange of contracts. See example of how much your deposit, mortgage and equity loan may be if you buy a new home worth £200,000.

Do I have to pay it back?

Help to Buy is not a discount scheme or a price reduction, it is a loan and therefore you will be required to pay back the money you borrowed eventually. You have the ability to pay off your equity loan in full or make part payments at any time – and will be required to repay the equity loan in full when you pay off your repayment mortgage, sell your home or reach the end of your loan term which is normally 25 years.

How can Flagstone help me with applying for a help to buy: equity loan?

Flagstone Financial are one of the largest introducers of mortgages in the UK as well as having access to the whole of market, Flagstone are able to access a large number of exclusive mortgage rates that are not available to the public.

If you are interested in Help to Buy: Equity Loan and finding out how it can help you buy your first home our Flagstone advisers are available to help guide you through the process from deciding if its suitable for you and submitting your application to following up through to completion.

If you would like to find out more about whether you are eligible for the Help to Buy scheme, contact us today.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE